Promoting Family Offices

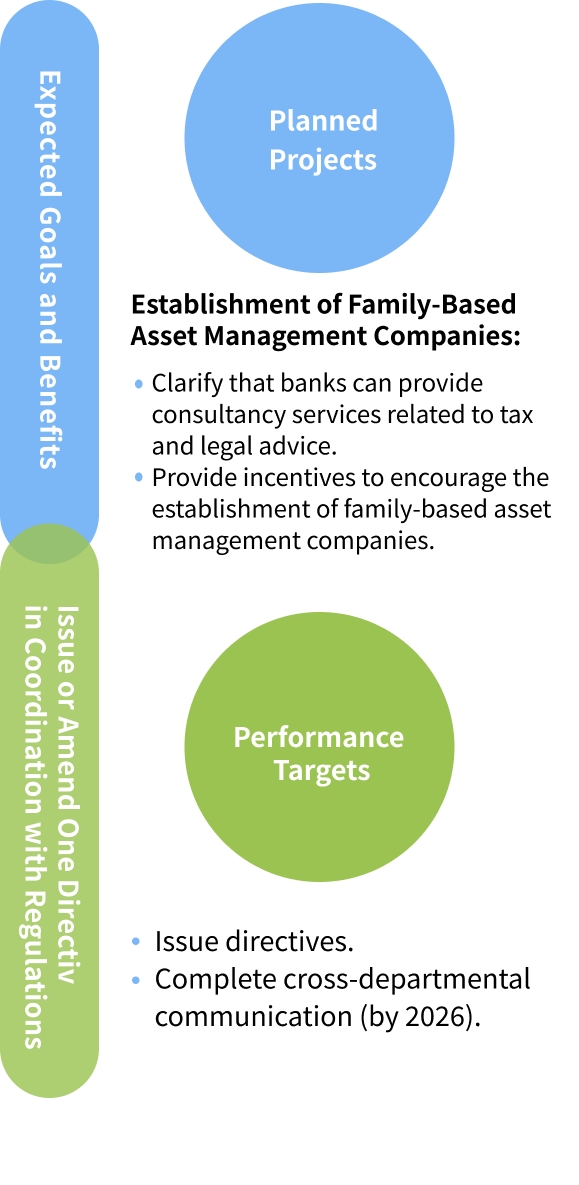

Family Legacy | Small and medium-sized enterprises (SMEs) have long been a critical driving force in Taiwan's economic development. As many SME owners are entering the stage of legacy planning, the development of family office services has become an important task for banks. Therefore, the Financial Supervisory Commission (FSC) will actively promote the establishment of family office businesses within banks, aiming to support the succession and sustainable development of Taiwan’s SMEs. |

Family Office | In cooperation with private banking initiatives and addressing the needs of high-net-worth clients, the creation of family offices will be guided to provide diversified asset management services, enhancing the functionality of family offices in Taiwan. In the future, various substantial investment incentives will be offered for family offices investing in key government-supported industries, assisting Taiwanese people in managing assets and investing in Taiwan. |

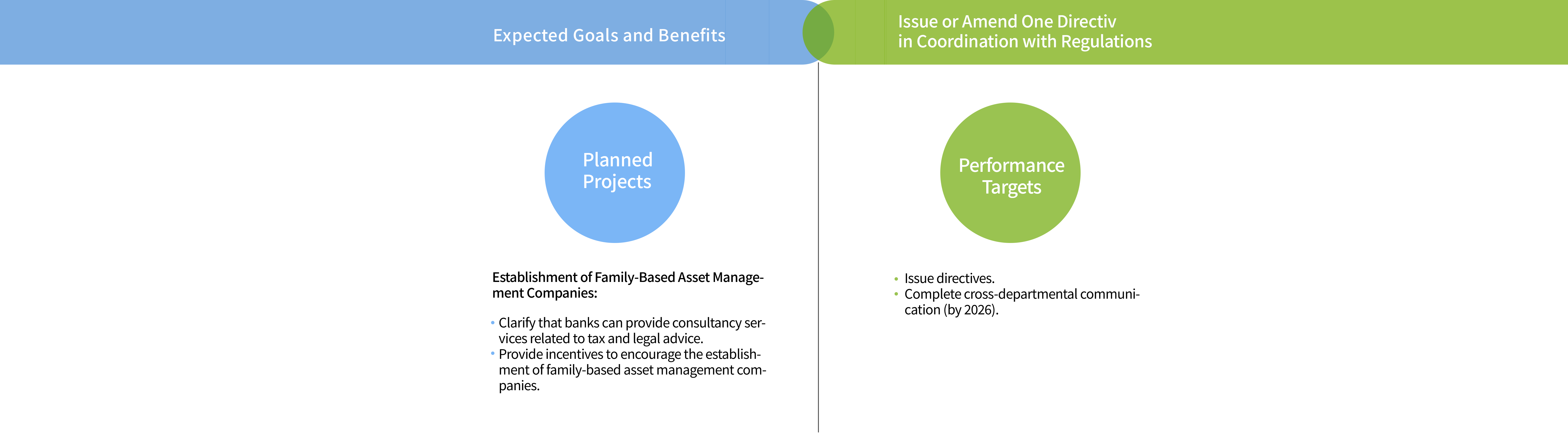

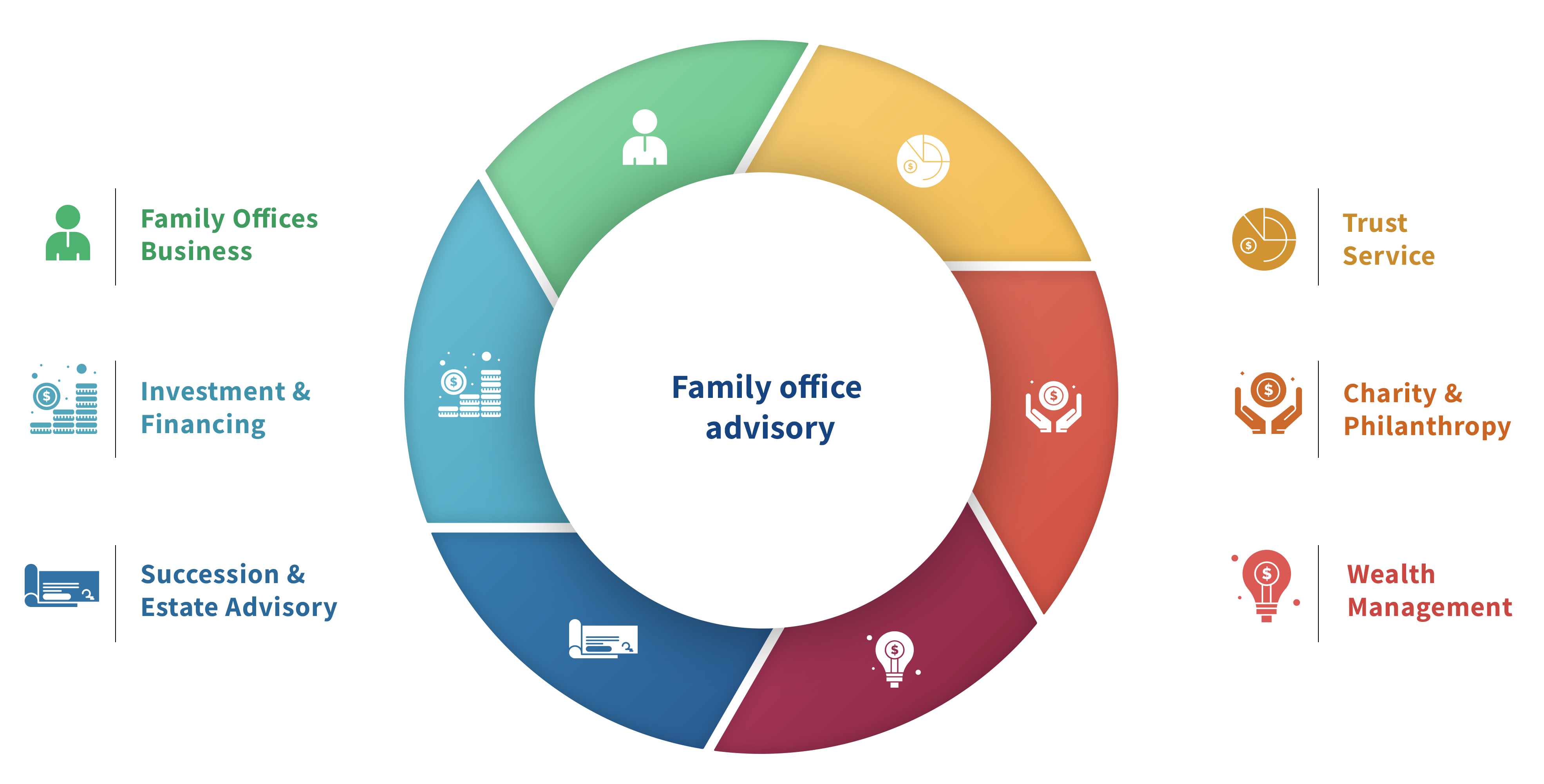

Specific Measures

Banking Bureau

- Family offices provide asset management and advisory consulting services to families, charging management fees for these services (note). As for multi-family offices (MFOs), the business model revolves around providing family office services. By referencing the establishment and licensing standards from Singapore and Hong Kong, they are more akin to investment trust and advisory services or discretionary management services.

Note: In the practices of Singapore and Hong Kong, a Single Family Office (SFO) that serves only one family does not need to apply for a license from regulatory authorities. - Under their current licenses, banks are already able to conduct family wealth management services, though they mainly focus on wealth planning and do not provide comprehensive family office services.

- There are already advisory services for family business succession offered in collaboration with accounting and law firms.

Securities and Futures Bureau

- As of September 2025, there are 87 SICEs, with a total of 77 companies which concurrent operation of securities investment consulting business, including 33 SITEs, 27 trust companies, 10 securities firms, and 7 futures firms.

- Currently, SICEs are allowed to provide clients with extended services, such as tax planning and insurance planning, which are supplementary to securities investment consulting business .

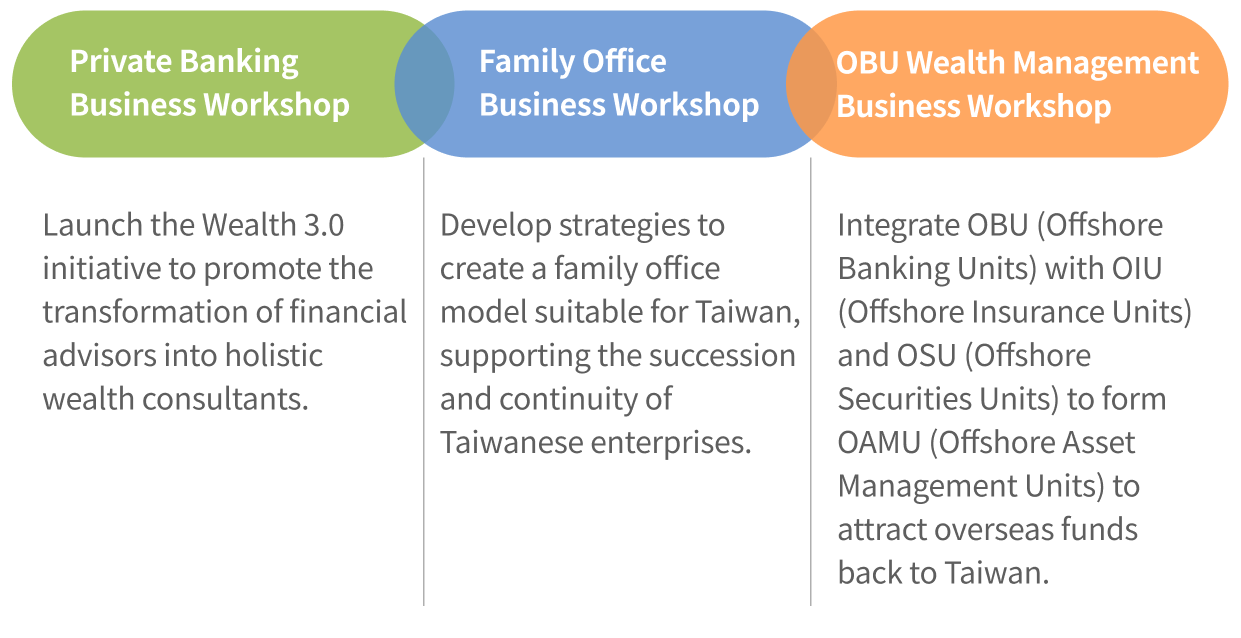

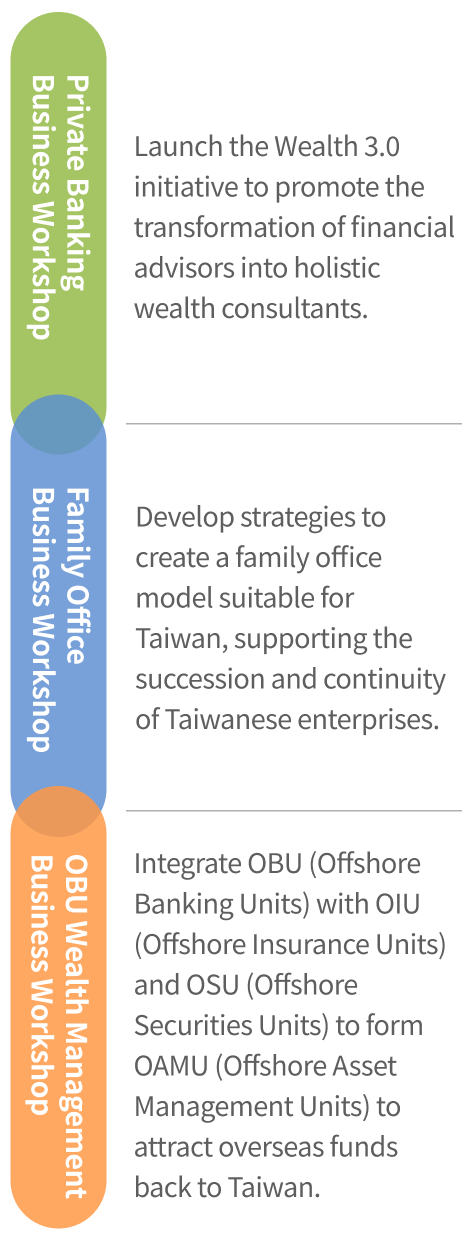

Establishment of Three Major Task Workshops

Family Office Asset Management Promotion Plan