Support TISA and Promote Asset Management Education

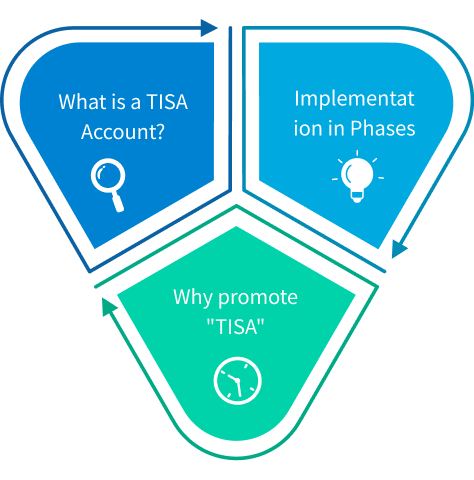

What is a TISA Account?

To promote the establishment of long-term investment and financial management concepts among citizens, the Taiwan Depository & Clearing Corporation (TDCC) has planned to establish a mechanism for investor TISA accounts under the existing centralized custody system. Investors can contact mutual fund distributors such as securities firms, banks, and other fund sales agencies to apply for the opening of a TISA account. An investor can only open one TISA account at the same mutual fund distributors. By opening a dedicated account, investors can manage their investment positions. In the future, if there are any tax incentives, they will be able to clearly calculate their investment principal and control the holding period.

Why promote "TISA"?

- Promote the establishment of medium to long-term stable investment and savings concepts among citizens.

- Enhance the public's knowledge of asset management and financial independence.

- Guide domestic funds to stay in Taiwan and invest in the local capital market.

- Respond to the challenges of an ultra-aging society by providing tools for citizens to manage retirement and living funds independently.

- Expand the internal circulation efficiency of Taiwan's financial assets, strengthening the depth and resilience of the capital market.

- Promote financial retention and attract investments to establish Taiwan as an asset management center in Asia.

How Implementation in Phases:

Phase One:Initially, establish a Taiwan-specific version of TISA without new tax incentives. The Financial Supervisory Commission (FSC) coordinates with the Taiwan Depository & Clearing Corporation (TDCC) to assist the public in setting up and managing dedicated accounts. Securities investment trust companies participating in the program will offer concessions up to a certain limit, using schemes such as discounted management and transaction fees as incentives to encourage citizens to open TISA accounts.

Second phase:

Continually communicate with various government departments regarding tax incentives and strengthen the integrity of the system.

TISA Investment Zone

The Financial Supervisory Commission (FSC) will coordinate with the Taiwan Depository & Clearing Corporation (TDCC) to assist the public in setting up and managing dedicated accounts. Subject to a specified cap, participating asset management firms will offer fee concessions by designing preferential management-fee and service/transaction-fee schemes as incentives to encourage people to open TISA accounts.

Outcome:

38 funds managed by 23 Securities investment trust companies have applied to issue TISA-class categories. (Data as of December 2025).