Background Introduction

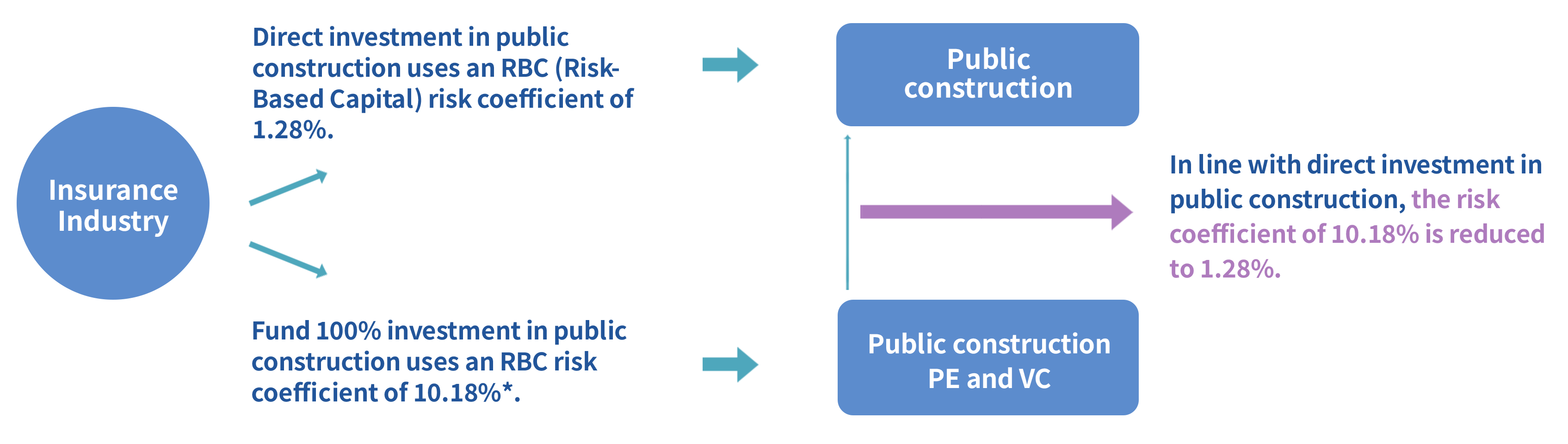

The insurance industry's funds have exceeded the absorption capacity of the domestic fixed-income bond market. As of December 2024, total funds held by the insurance industry amounted to approximately NT$33.3 trillion, while the size of the domestic bond market accounted for only one-third of the investable funds of the insurance sector. Due to the need for asset-liability duration matching, the insurance industry must invest in overseas fixed-income financial instruments.

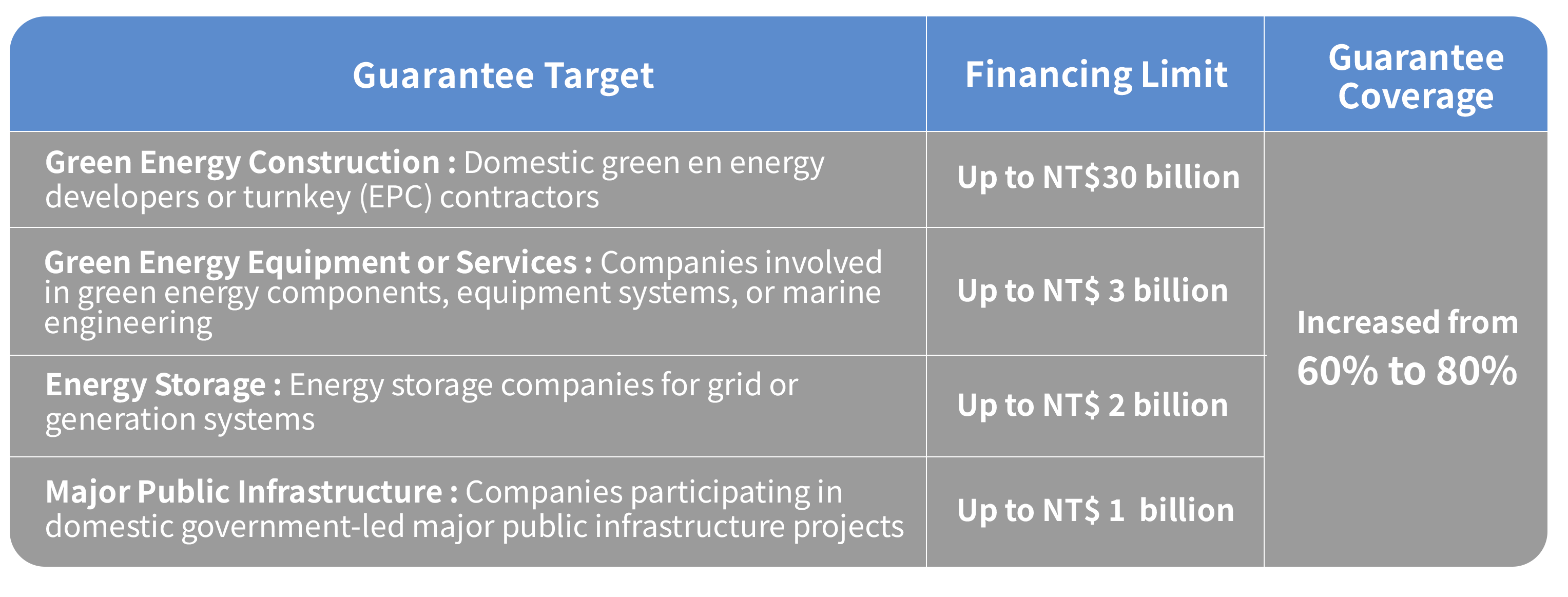

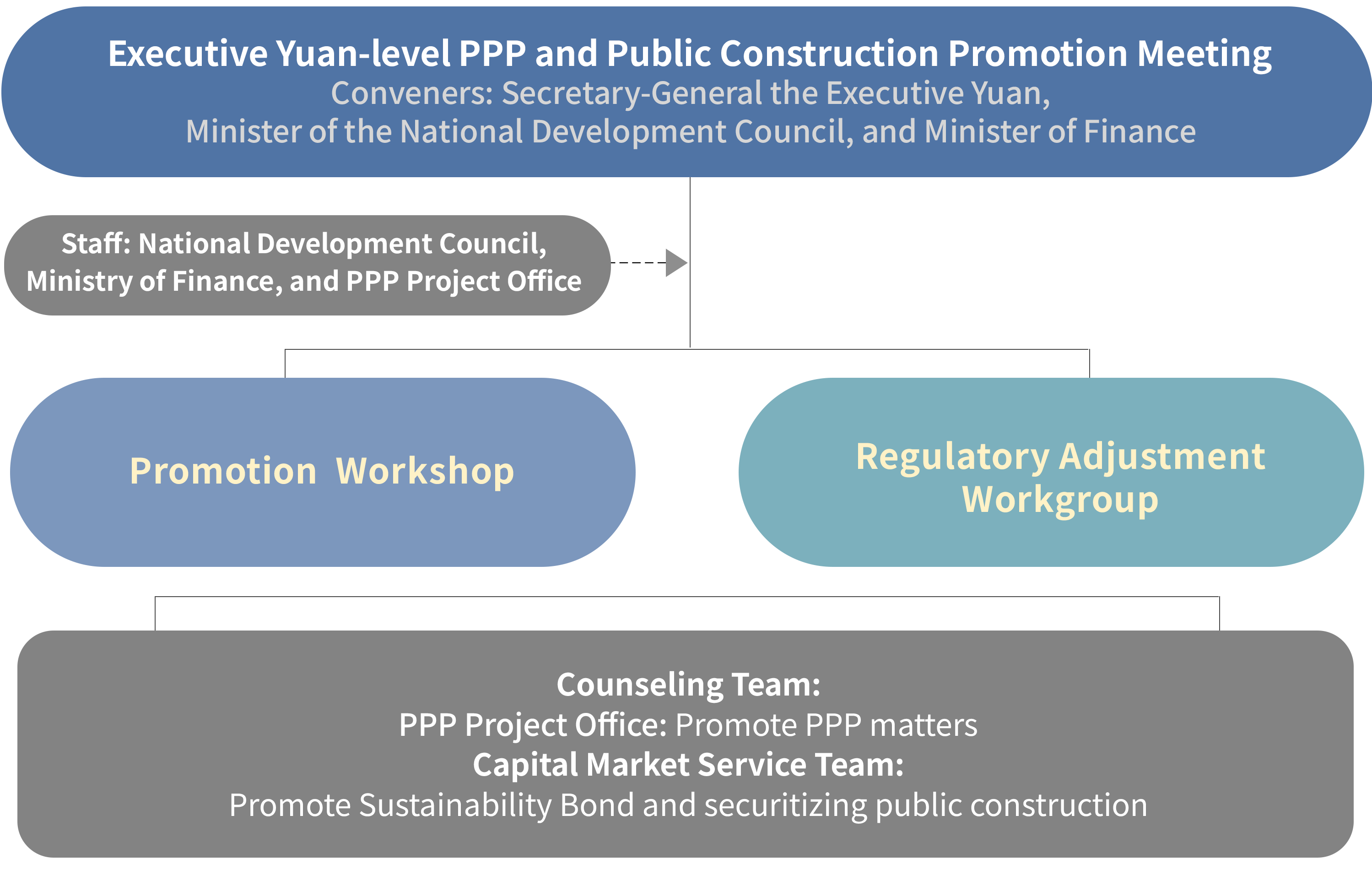

The "Trillion NT Dollar Investment National Development Plan," approved by the Executive Yuan, introduces three major strategic pillars: including an Innovative PPP Promotion Mechanisms, Enhancing financing and investment conditions, and Diversifying financial products, guiding insurance funds into the public infrastructure sector.

The historical achievements of private sector participation in public infrastructure investments are shown in the following chart (which can be linked to the Public-Private Partnership Division’s website for real-time updates).

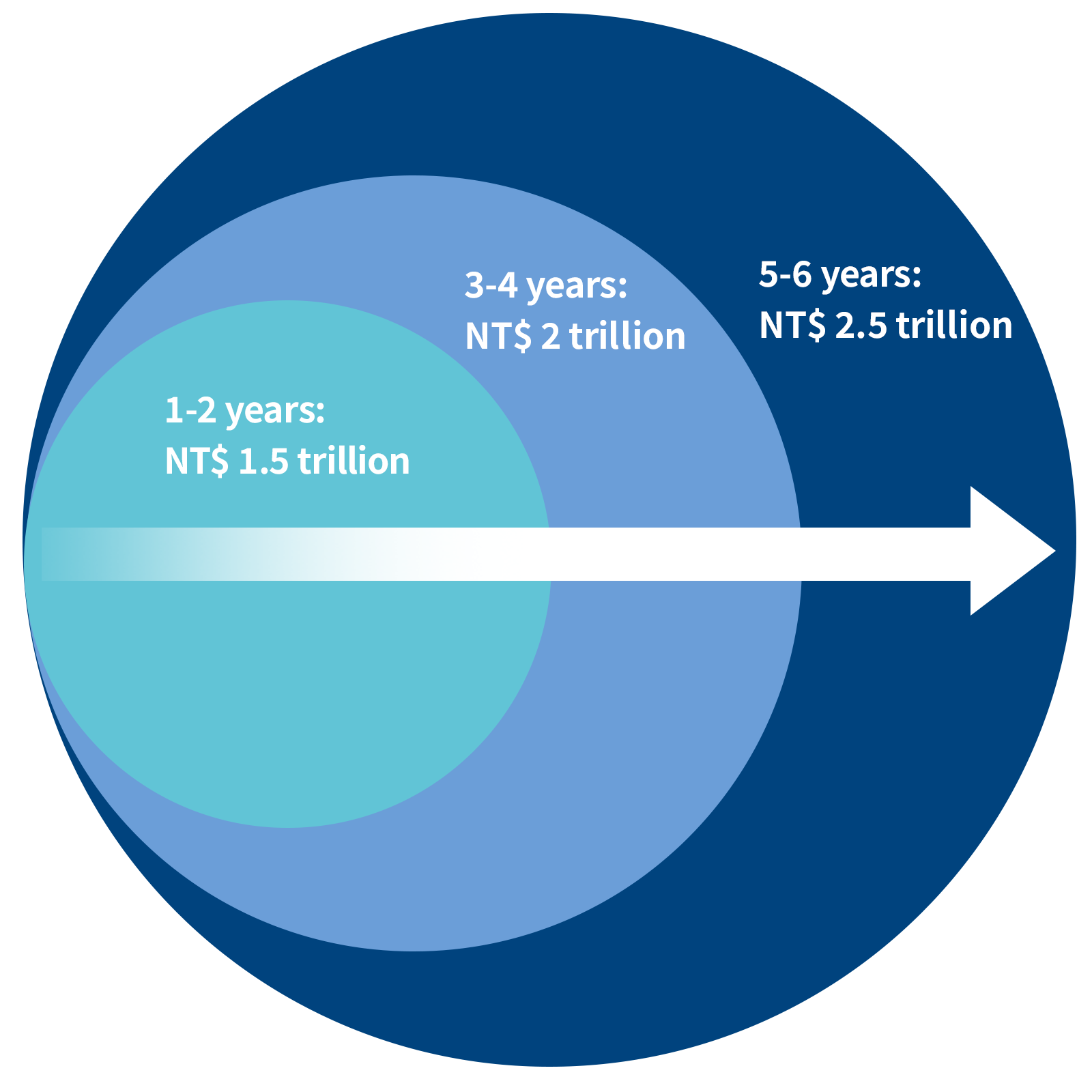

The goal is to attract domestic investment by the insurance industry through policy incentives, aiming for:

New Amount of Domestic Investment by the Insurance Industry

Source: Department of Public Affairs

Future: Expected Outcomes

The Asia Asset Management Center plans to promote project planning for public construction and product development, facilitate public infrastructure investment, advance strategic investment projects, and implement REIT promotion initiatives. These measures aim to guide and encourage insurance industry funds to invest directly and indirectly in domestic public infrastructure, the aging society and silver-haired industry, and strategic industries.

The expected outcomes are:

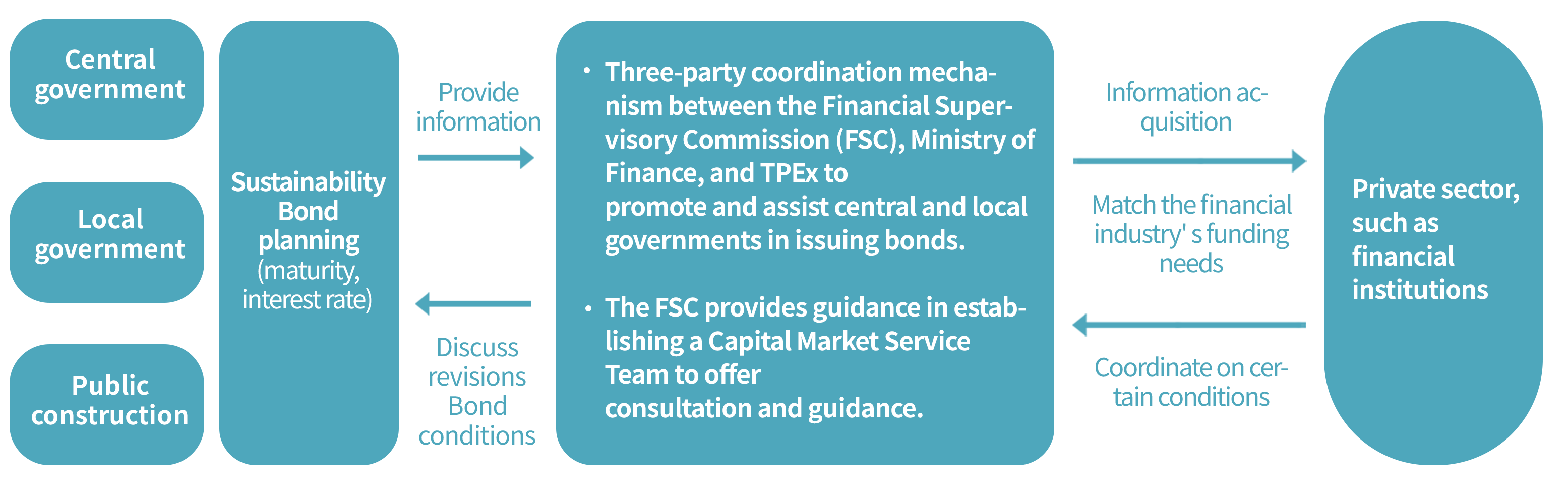

- Innovative Promotion Mechanisms

- Enhancing financing and investment conditions

- Diversifying financial products

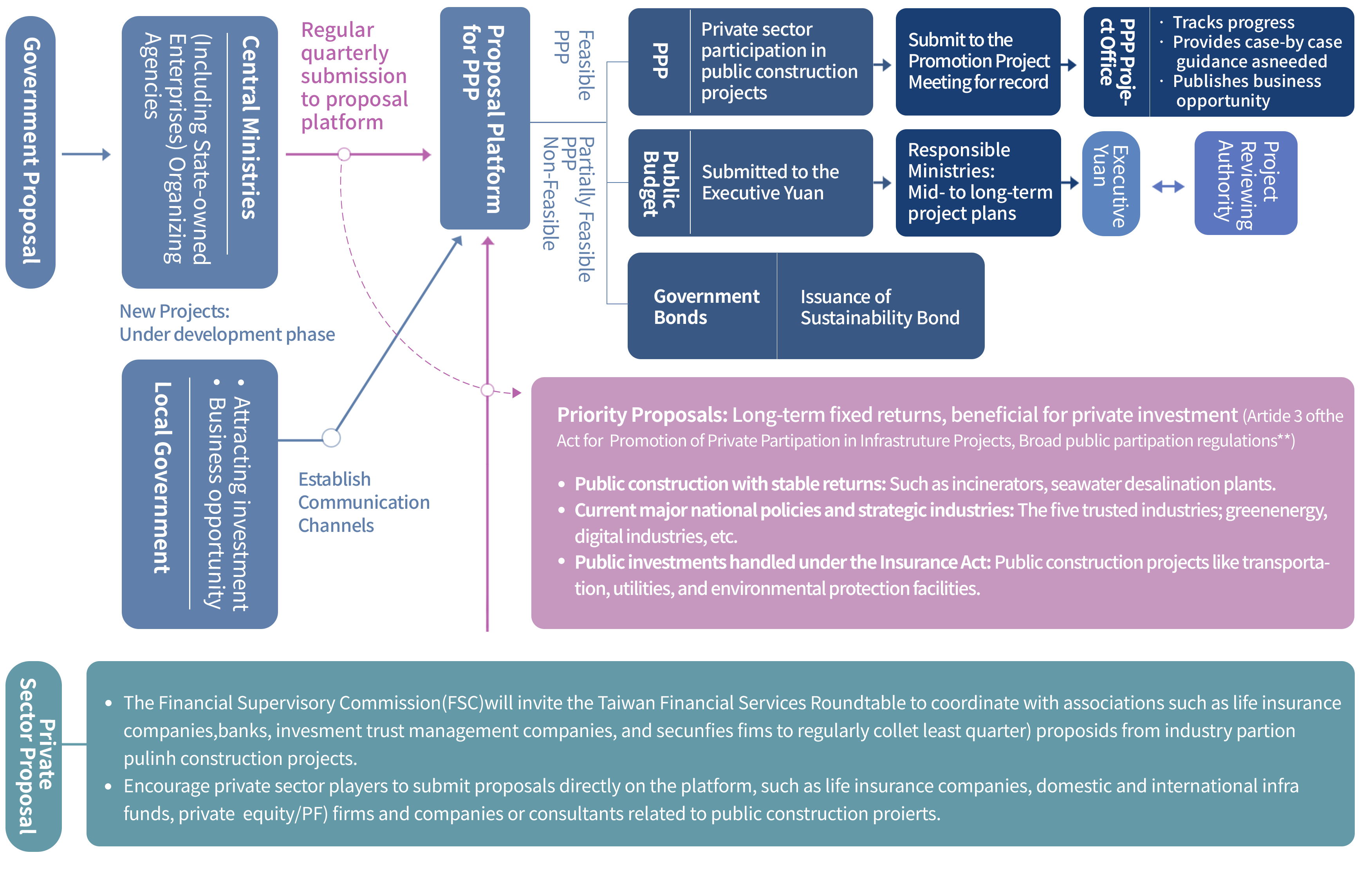

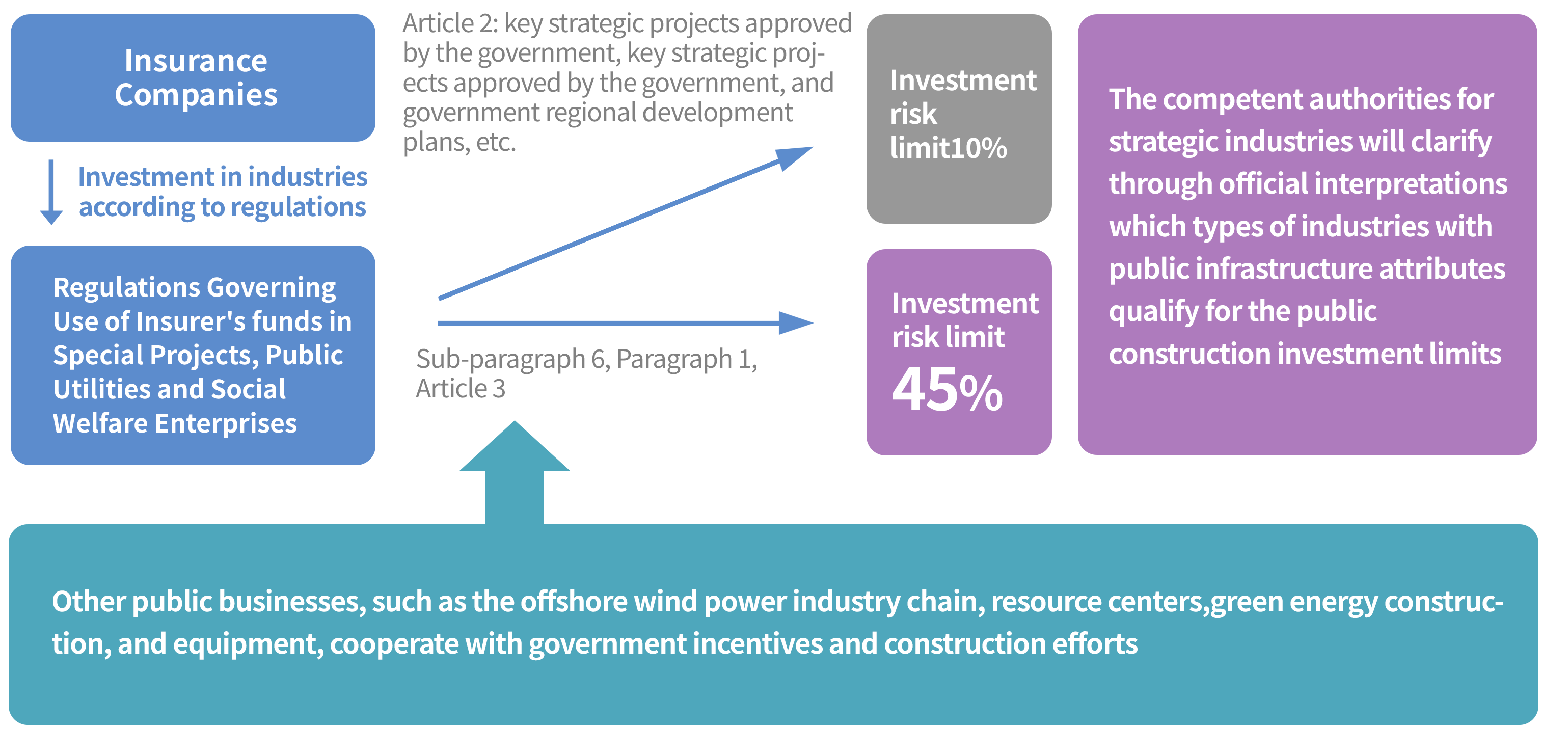

Through a platform established via inter-ministerial collaboration, private sector operators can access abundant public infrastructure project sources for investment reference. Regarding the target to promote public-private partnership projects totaling 684.9 billion NTD over the next four years, the operation of the proposal platform is divided into two main parts: government proposals and private sector proposals.

Government Proposals

Central government ministries under the Executive Yuan are required to submit quarterly reports to the proposal platform during the feasibility assessment and planning stages of emerging public infrastructure projects. Projects that offer stable returns and are conducive to private investment will be prioritized as proposals. In addition, infrastructure projects related to major Executive Yuan policies, such as the 5+2 Industrial Innovation Plan and green energy construction, are also included in the prioritized proposal categories.

Private Sector Proposals

Encourages all types of private sector participants, including the financial industry, to actively engage. The Financial Supervisory Commission (FSC) is responsible for supervising the Taiwan Financial Service Roundtable and related financial associations to regularly collect investment suggestions from financial and insurance companies. These suggestions are consolidated and submitted to the proposal platform. Meanwhile, individual private sector participant may also directly submit proposals through the platform.