Policy Objective

Encourage the insurance industry to invest in public infrastructure, aging society, and silver industry promoting social welfare through diversified channels, either directly or indirectly.

As of the fourth quarter of 2025, the total amount invested in special project investments in public and social welfare undertakings (including investments through land usufruct rights, securities, and other channels) is approximately 655 billion NTD, of which the amount applied under Article 146-5 of the Insurance Act is 186 billion NTD, accounting for 0.5% of the funds.

Promotional Measures

☑️ Expand the Scope of Special projects, Public Investments and social welfare enterprises by Insurance Industry FundsTo encourage insurer’s funds into domestic public infrastructure and physical industries, the FSC has amended “Regulations Governing Use of Insurer's funds in Special Projects, Public Utilities and Social Welfare Enterprises “on October 28,2025. The amendments include:

- Increased the total amounts of special projects, public Investments and social welfare enterprises from 10% to 15% of insurer’s total funds, expecting to increase trillion NT dollars domestic investments.

- Expanded the scope of insurer’s funds:

- Increased the investment amounts that insurance companies can invest without going through the application procedure, simplifying administrative procedures, and expedite the investment process.

Infrastructure and public investments NT$ 500 million → 1 billion Invested entity regulated by the Act for PPP NT$ 1 billion → 2 billion Other invested entity NT$ 50 million → 100 million

☑️ Expanding the Scope of secured loans by Insurance Industry Funds

Implementation Status:

loans secured by real property made by insurance companies expanded to offshore wind power construction vessels (powered vessels with a gross tonnage of 20 tons or more, or non-powered vessels with a gross tonnage of 50 tons or more) as collateral. (Interpretive orders issued on October 15, 2025)

☑️ Targets Promoting Social Welfare such as Aging Society and Silver-haired Industry

Encourage the insurance industry to invest in silver-haired ecosystems and related industries through diversified channels such as securities, real estate (e.g., elderly housing), and insurance-related businesses (e.g., elderly care and childcare services). Discussions will be held with life and property insurance associations and industry players to assess actual investment needs and adjust regulations as necessary.

Implementation Status:

- Added the health and welfare businesses that are combined with insurance claims, underwriting, policyholder services or insurance product payments fall under the category of other insurance related businesses recognized by the competent authority as referred to in Article 146, Paragraph 4 of the Insurance Act. (Interpretive orders issued on October 27, 2025)

- Continuing to promote the "Program to Encourage Insurers to Invest in the Six Core Strategic Industries, Public Infrastructure, Long-term Care Enterprises, and Sustainability Bonds". The program is implemented in four phases from July 1, 2022, to December 31, 2025.

☑️ Indirect investment through venture capital enterprises and private equity funds:

Implementation Status:

- Discussed adding venture capital and private equity awards to the incentive investment program for the five trusted industries.

- Expanded the investment scope of private equity funds to include Public-Private Partnership (PPP) projects, infrastructure approved by government, social welfare enterprises, and ESG-related projects.

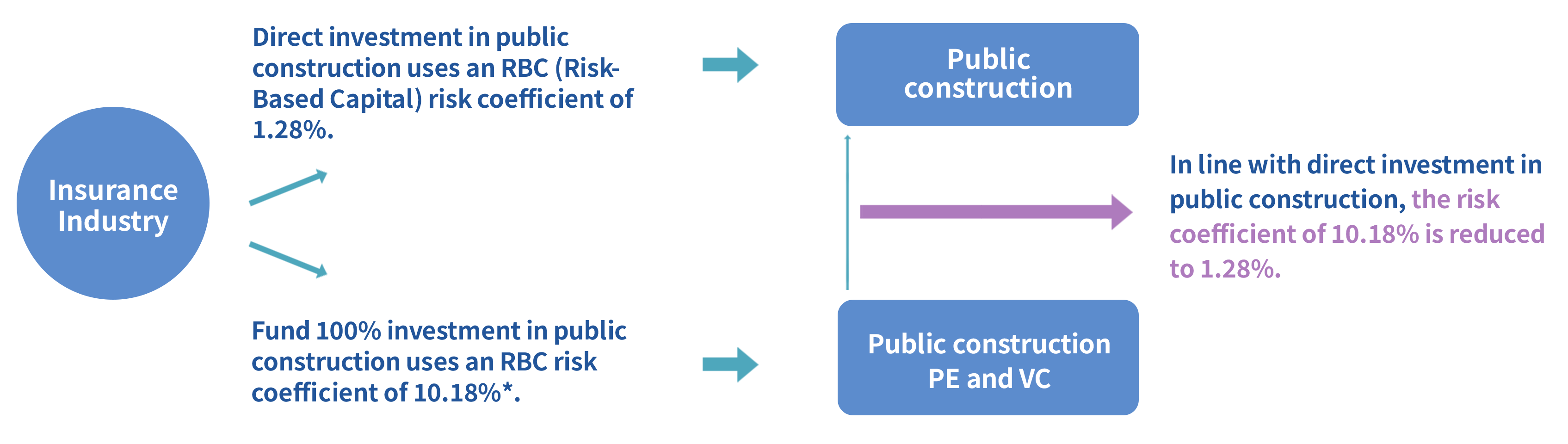

(Interpretive orders issued on October 28, 2025) - Relaxed the rules for insurance companies investing 100% in public infrastructure either directly or through domestic private equity funds and venture capital enterprises, applying a risk factor of 1.28% during the investment period.

(Interpretive orders issued on September 12, 2024, and December 13, 2024)