Taiwan has a sizable high-net-worth clientele, with assets growing rapidly. On August 7, 2020, the Financial Supervisory Commission (FSC) issued the " Regulations Governing Banks Conducting Financial Products and Services for High-Asset Customers," which, through regulatory relaxation, eased restrictions on banks providing diversified products and advisory services to clients with assets exceeding NT$100 million. The initiative also aims to strengthen banks’ capabilities in product development and talent cultivation, thereby promoting the overall development of the wealth management market.

Comprehensive Promotion of Private Banking Business

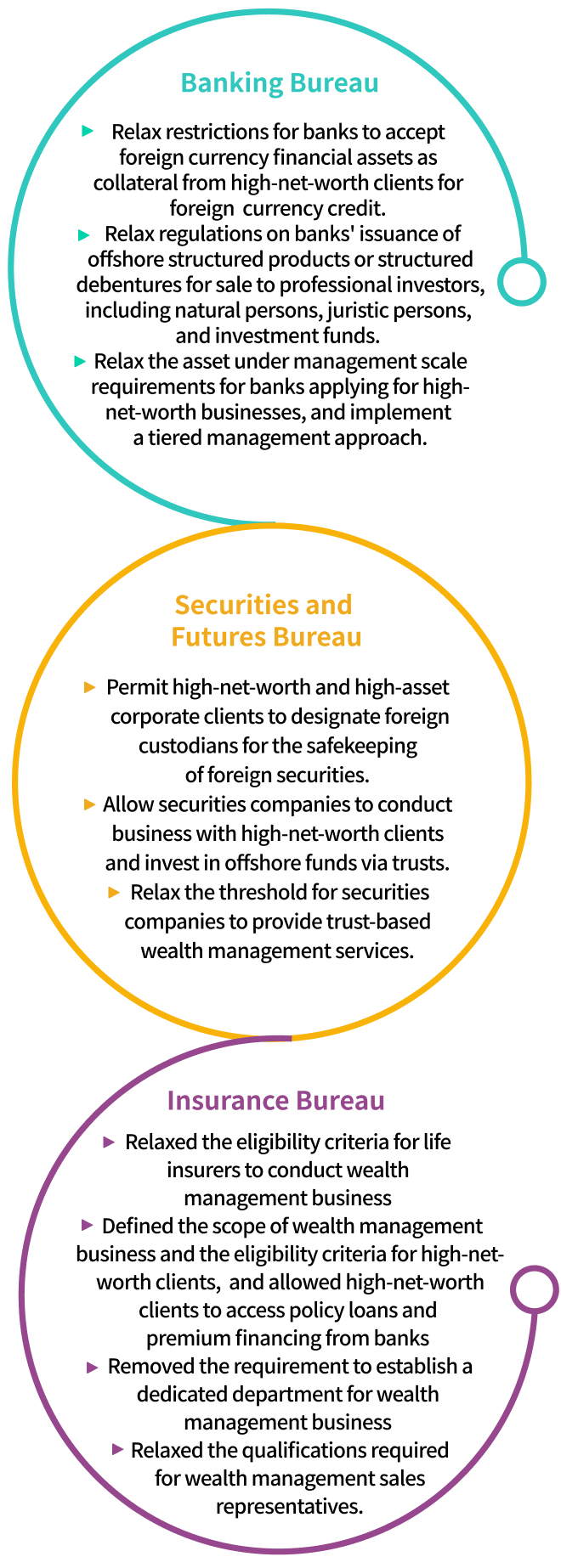

Implementation Measures

Benefits to Financial Market

As of the end of December 2025, the relevant data is as follows:

21 banks

have been approved to conduct high-net-worth business.NT$2.08 trillion

Cumulative Assets Under Management (AUM) for high-net-worth clients as of November 2025.As of November 2025, a total of six companies in the insurance industry, including Shin Kong Life Insurance, Nan Shan Life Insurance, Fubon Life Insurance, Cathay Life Insurance, KGI Life Insurance, and Taiwan Life Insurance, have been approved by the Commission to conduct wealth management business in accordance with the "Directions for Life Insurance Companies Engaging in Wealth Management Business ".

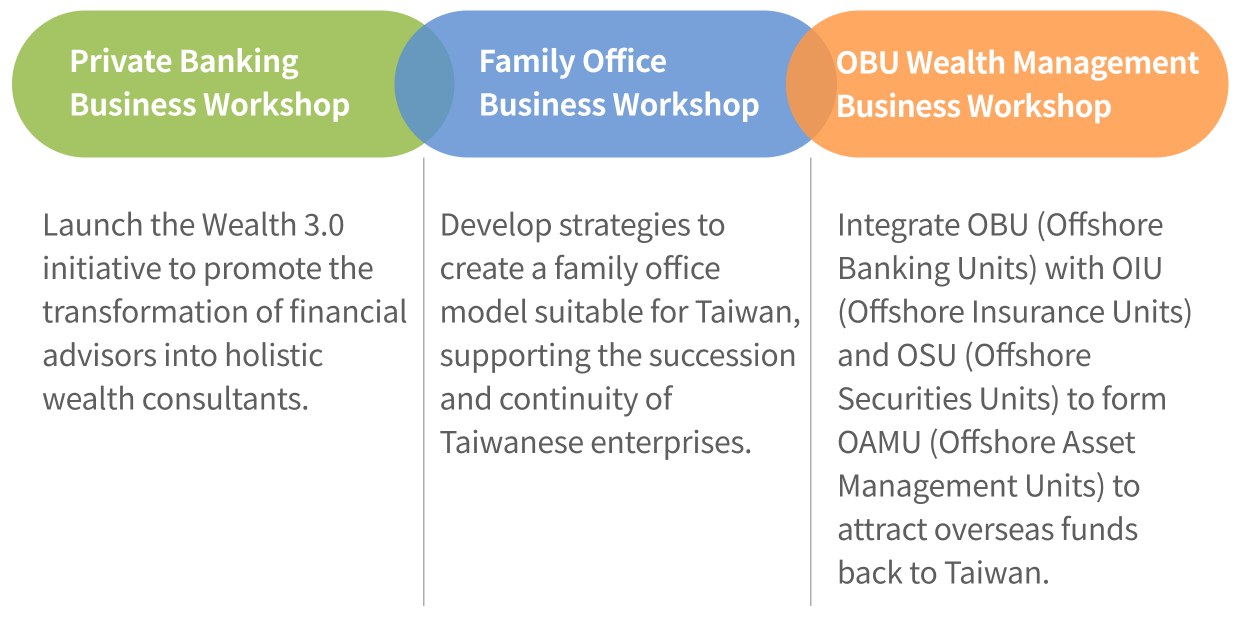

Establishment of Three Major Task Workshops

Key Goals